A modern approach:

Converting risk

into resilience

Converting risk

into resilience

Converting risk into resilience

insurable is a modern approach to insurance, protecting against our extreme Australian climate and providing financial resilience for our farming communities, using transformative and innovative solutions.

insurable is a modern approach to insurance, protecting against our extreme Australian climate and providing financial resilience for our farming communities, using transformative and innovative solutions.

insurable is a modern approach to insurance, protecting against our extreme Australian climate and providing financial resilience for our farming communities, using transformative and innovative solutions.

insurable is a modern approach to insurance, protecting against our extreme Australian climate and providing financial resilience for our farming communities, using transformative and innovative solutions.

SIMPLE, RELIABLE, INNOVATIVE

Our products are scalable, customisable and reliable to protect every corner of our diverse landscape, reducing the protection gap for climate-exposed regional industries and replacing it with peace of mind during critical harvest periods.

Request a Quote

OUR SERVICES

01.

01.

01.

01.

Weather

Weather

Weather

Weather

BEST SUITED FOR

Quick, transparent payouts

Lower administrative costs

Ideal for hard-to-insure or remote regions

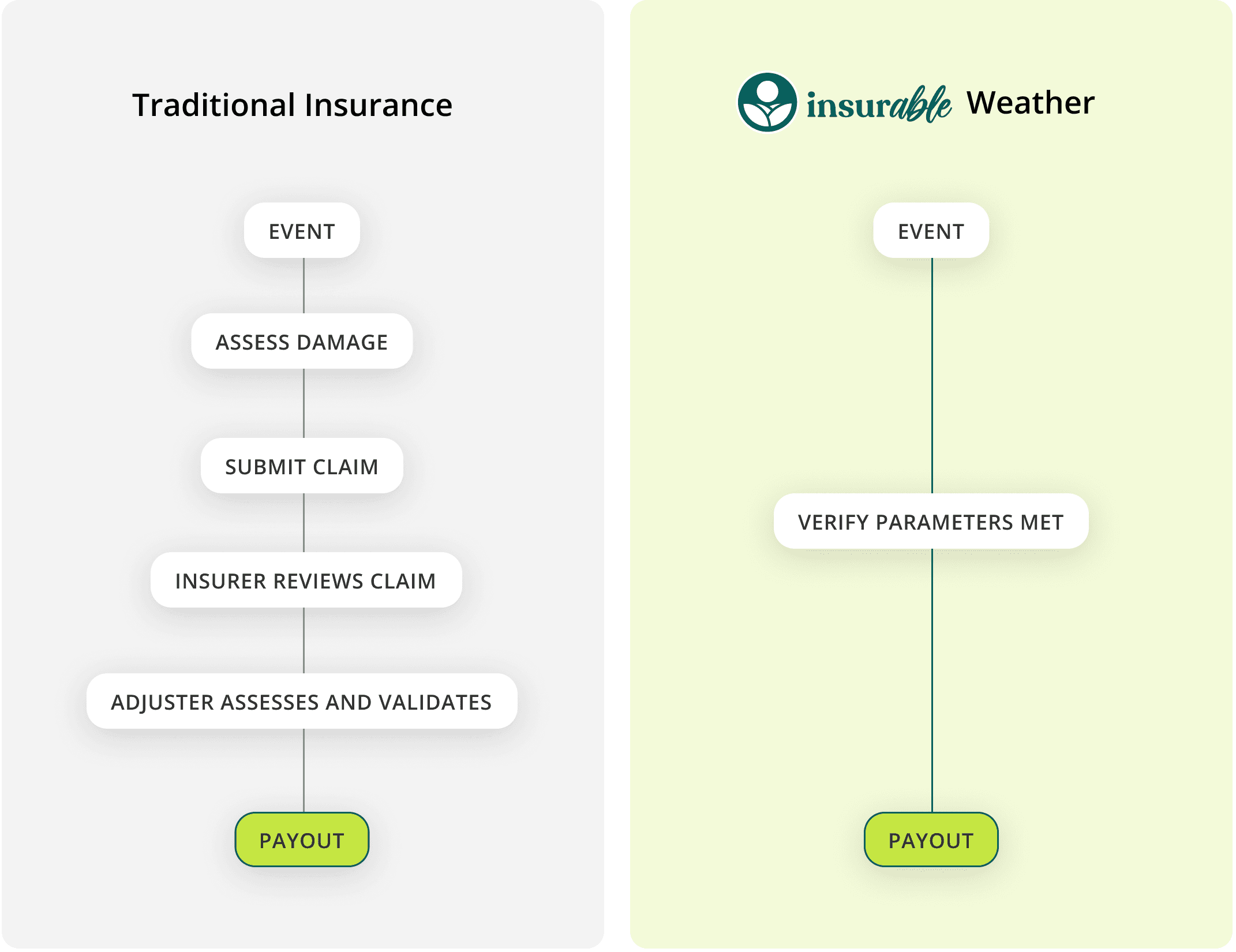

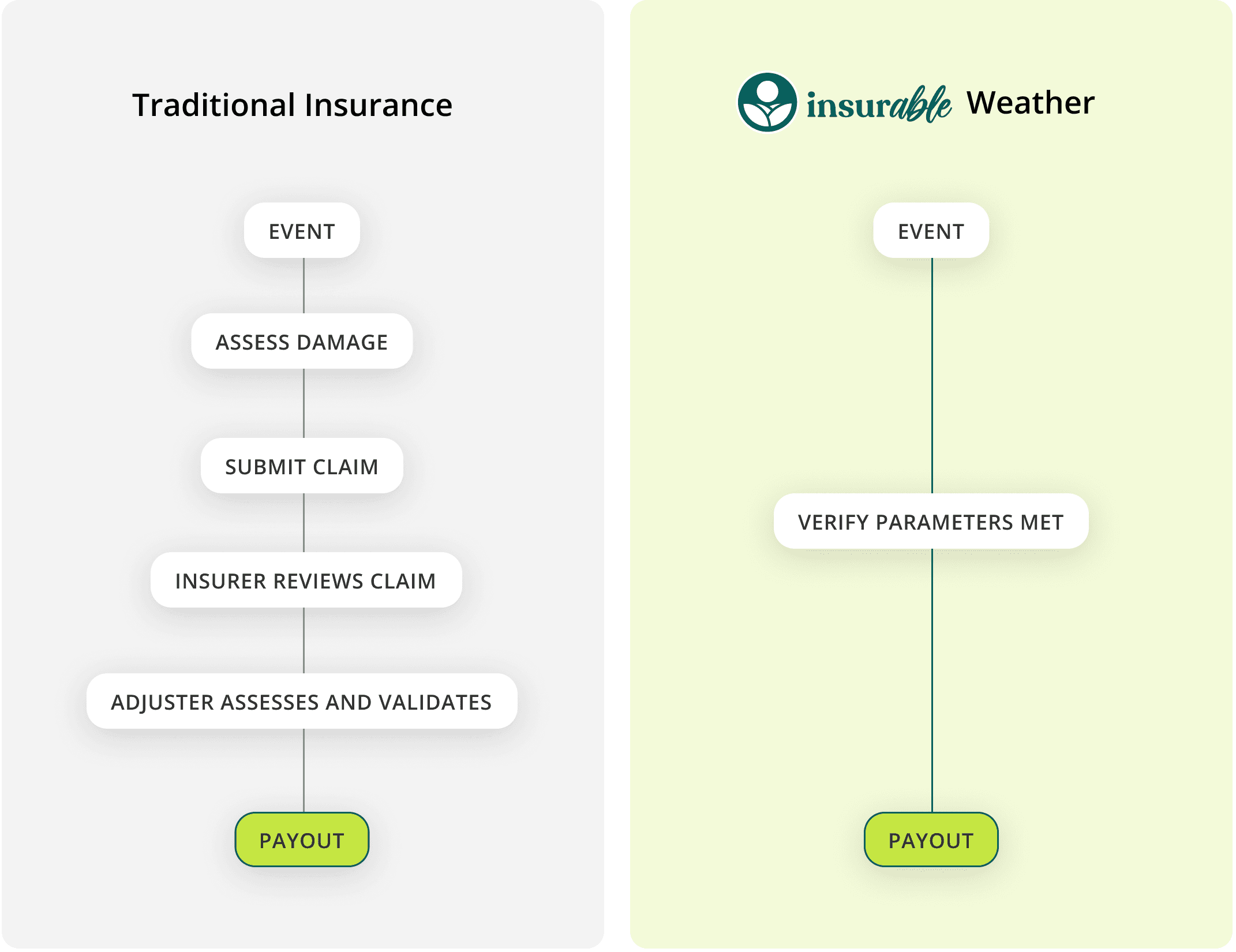

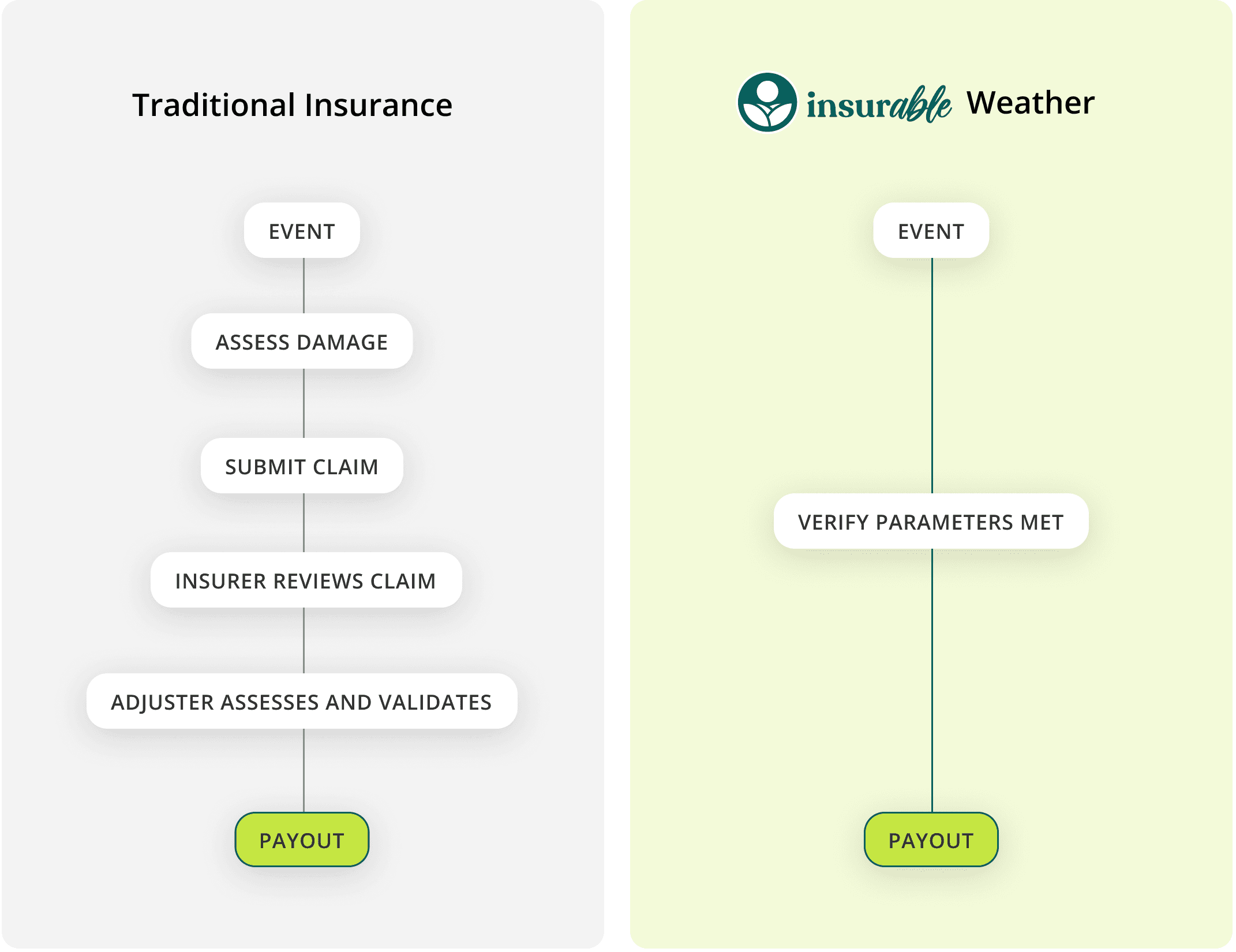

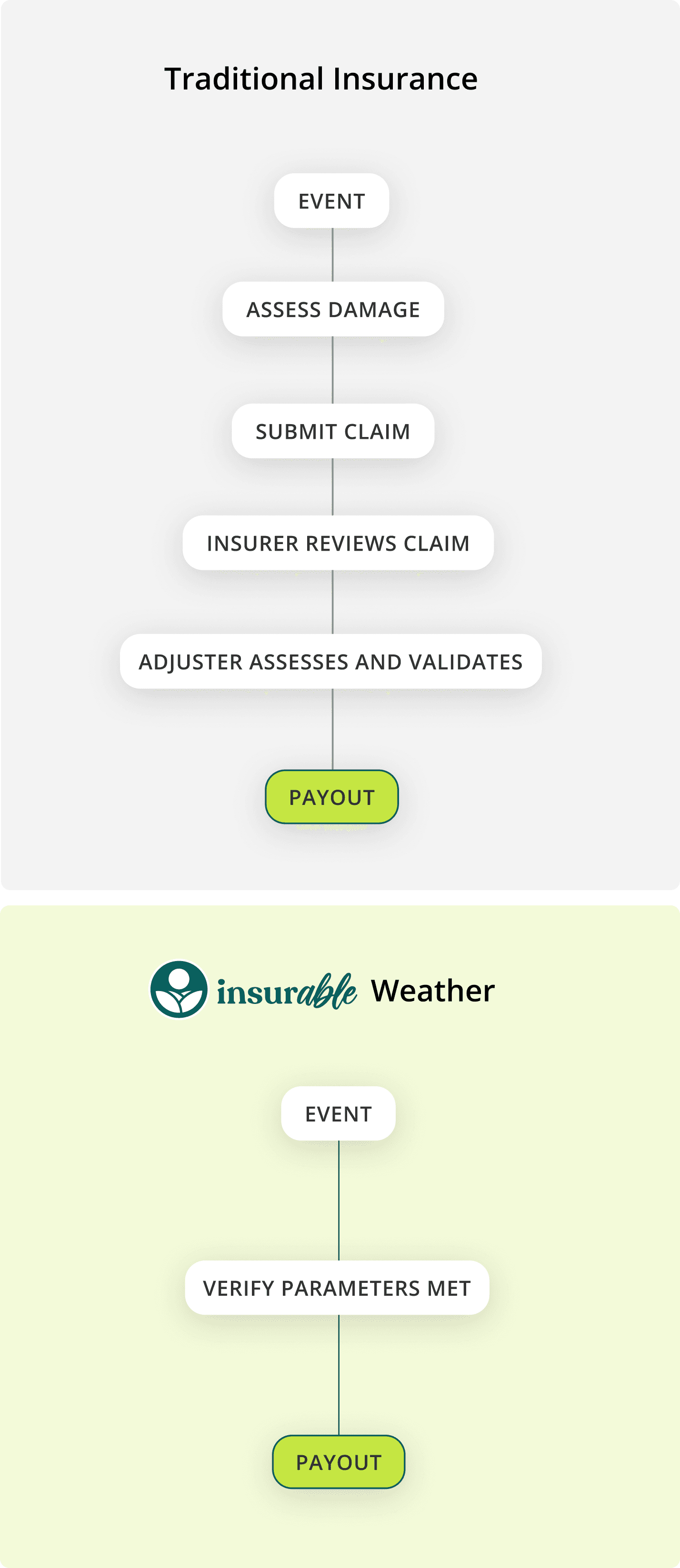

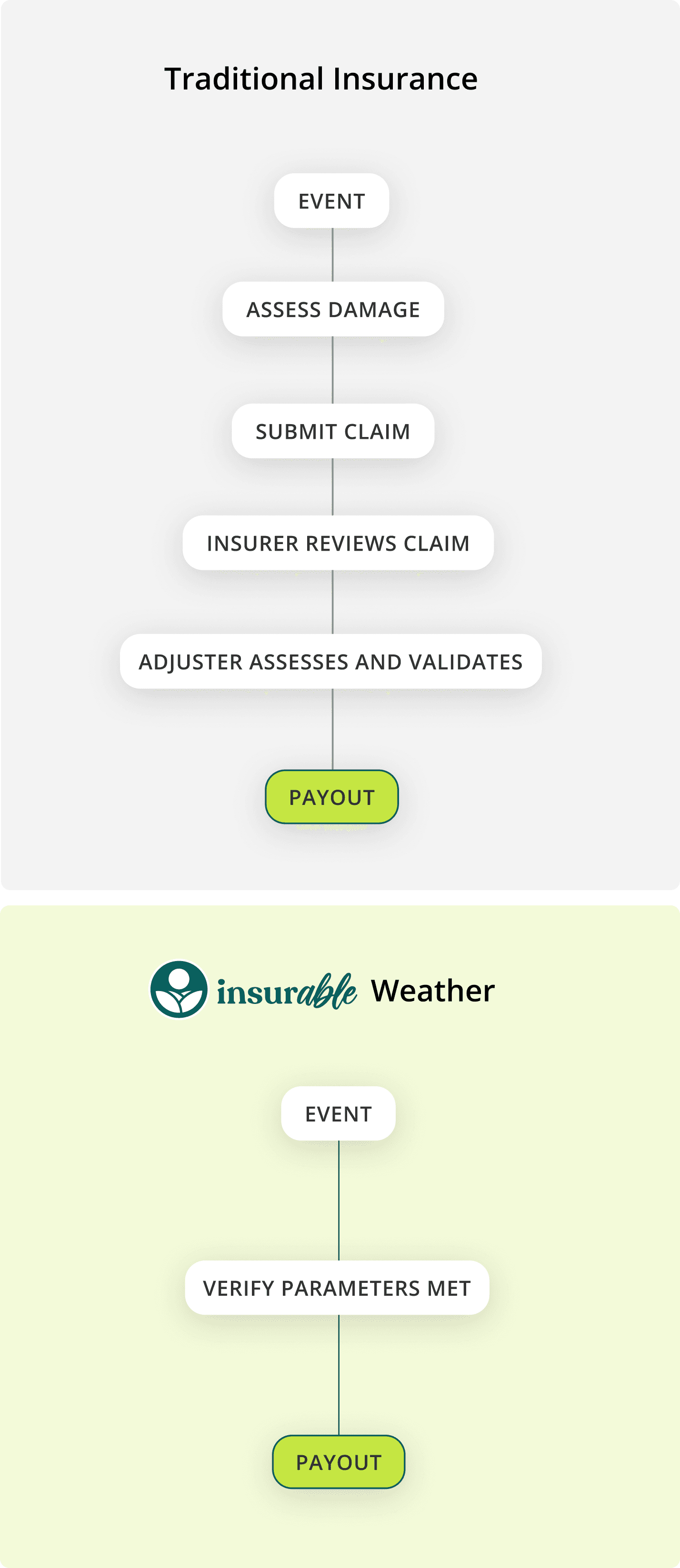

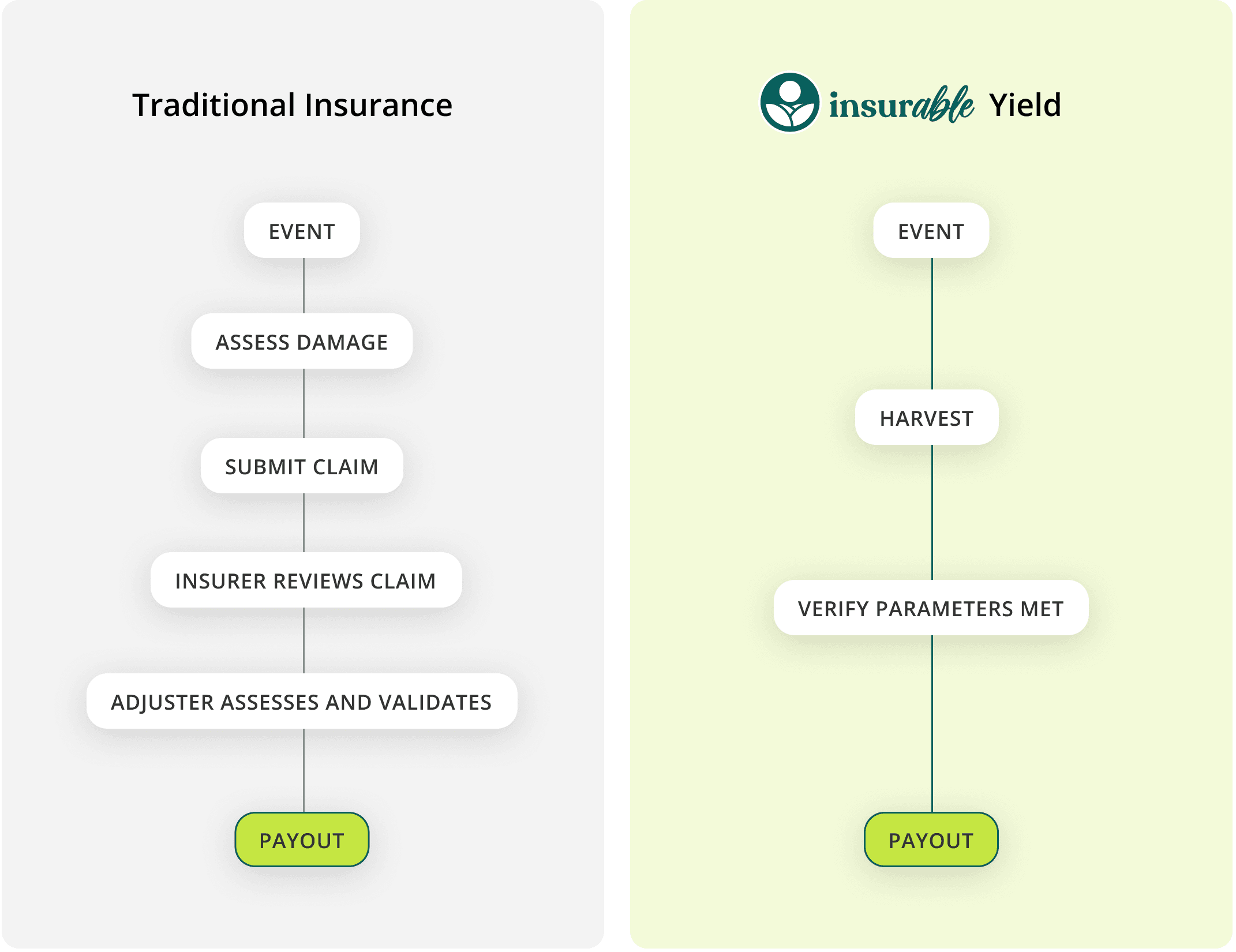

insurable Weather is a type of insurance that pays out a predetermined amount when a specific event or condition occurs, rather than reimbursing actual losses incurred.

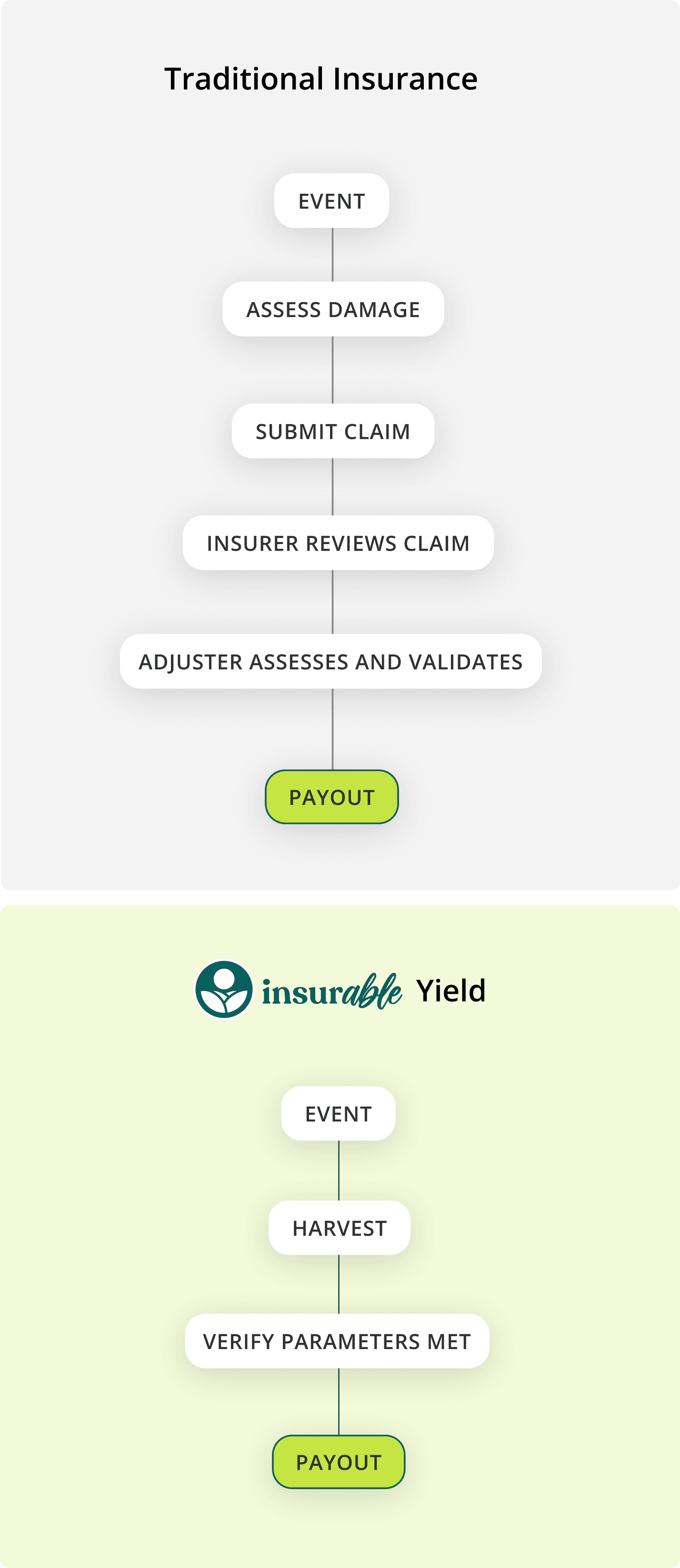

It differs from traditional insurance, which compensates policyholders based on assessed damage or loss.

insurable Weather is a type of insurance that pays out a predetermined amount when a specific event or condition occurs, rather than reimbursing actual losses incurred.

It differs from traditional insurance, which compensates policyholders based on assessed damage or loss.

insurable Weather is a type of insurance that pays out a predetermined amount when a specific event or condition occurs, rather than reimbursing actual losses incurred.

It differs from traditional insurance, which compensates policyholders based on assessed damage or loss.

Key features

of insurable Weather

AUTOMATIC – NO FUSS

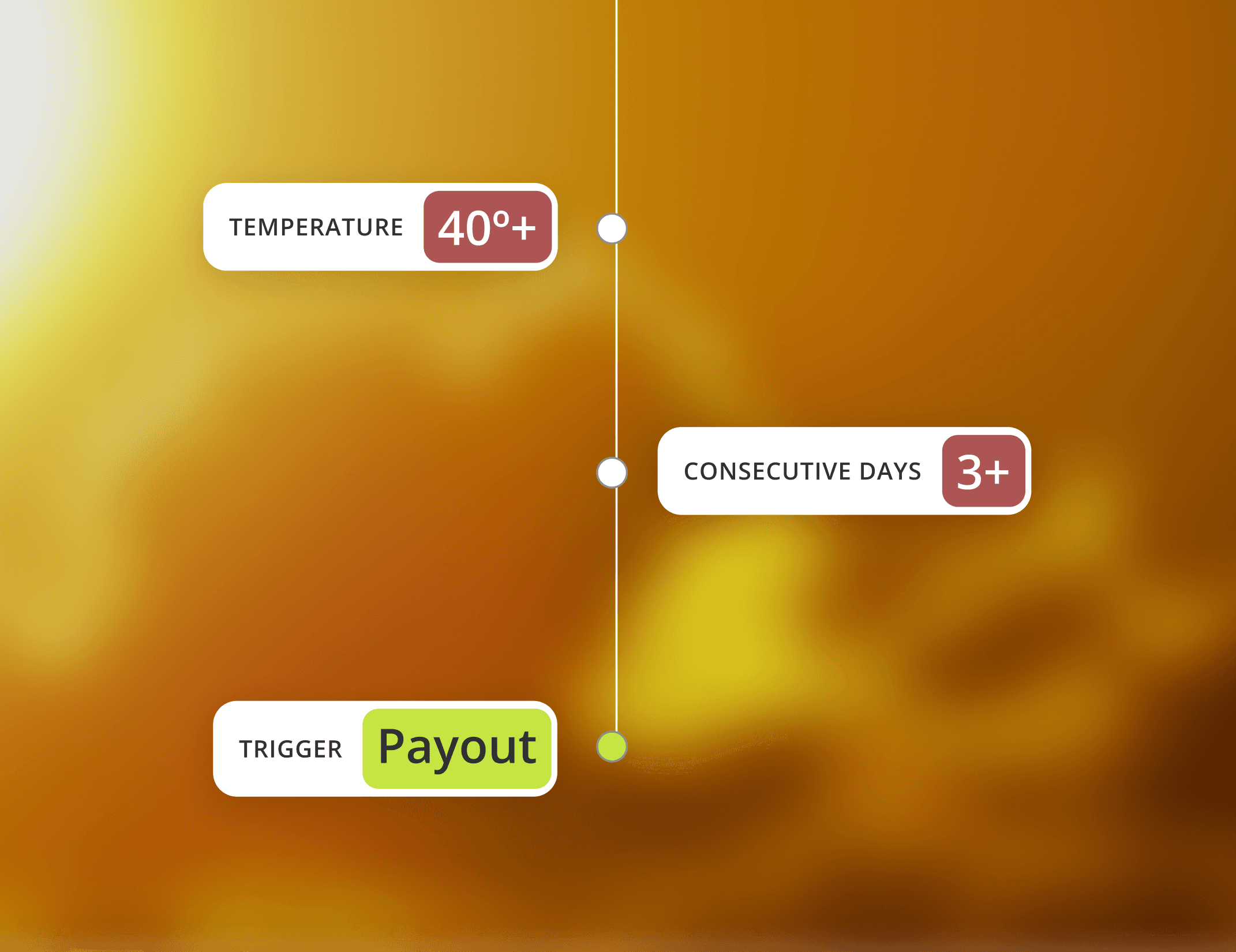

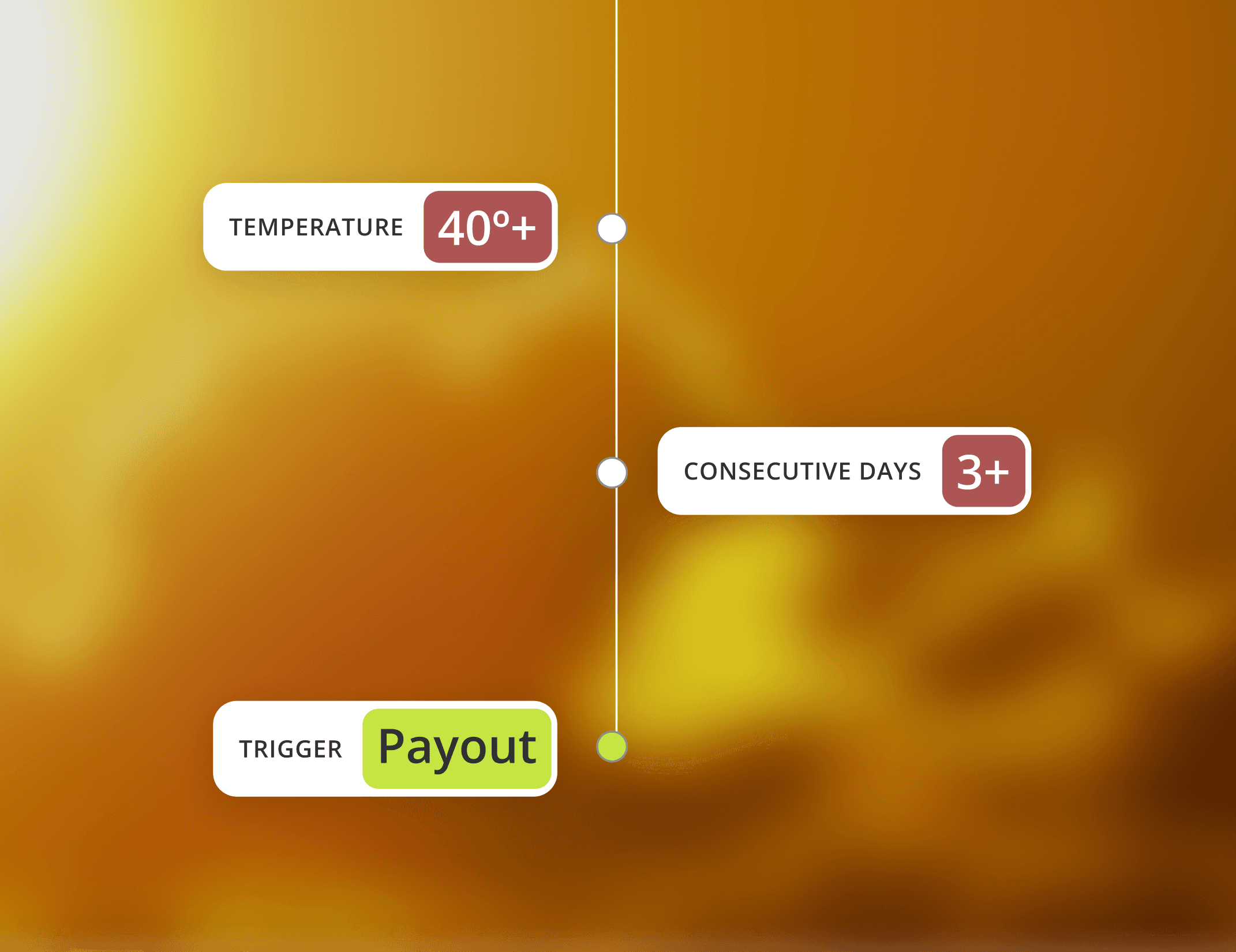

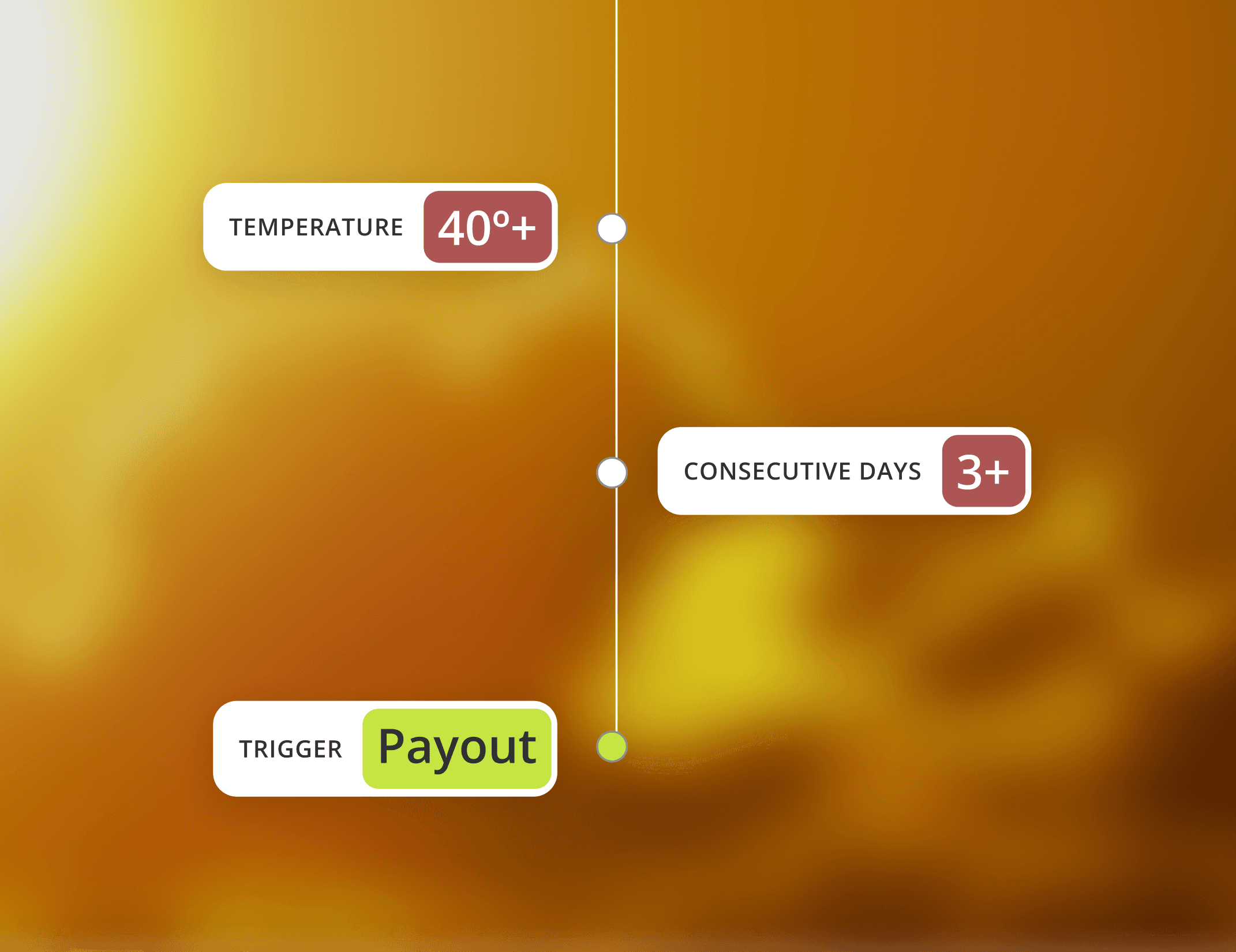

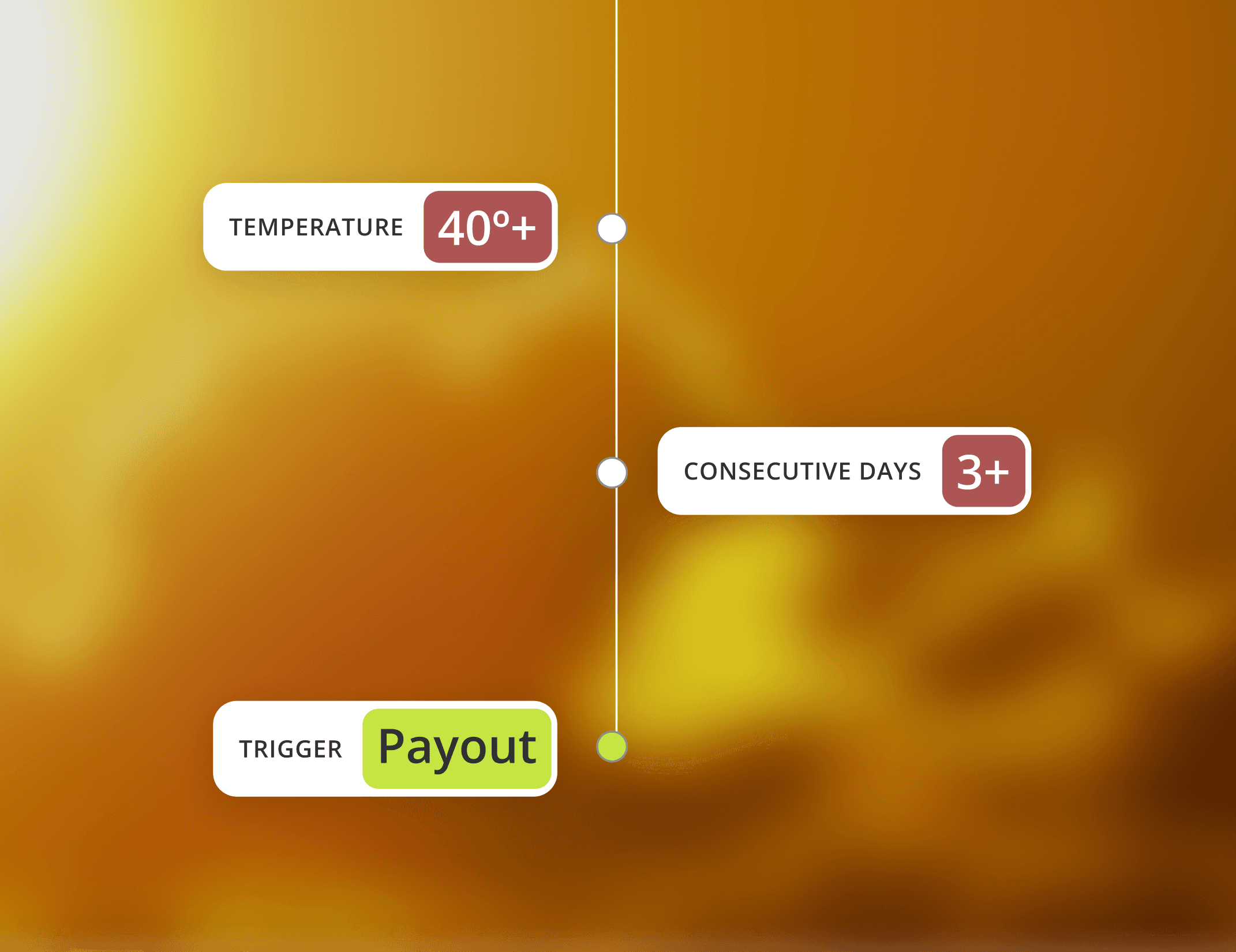

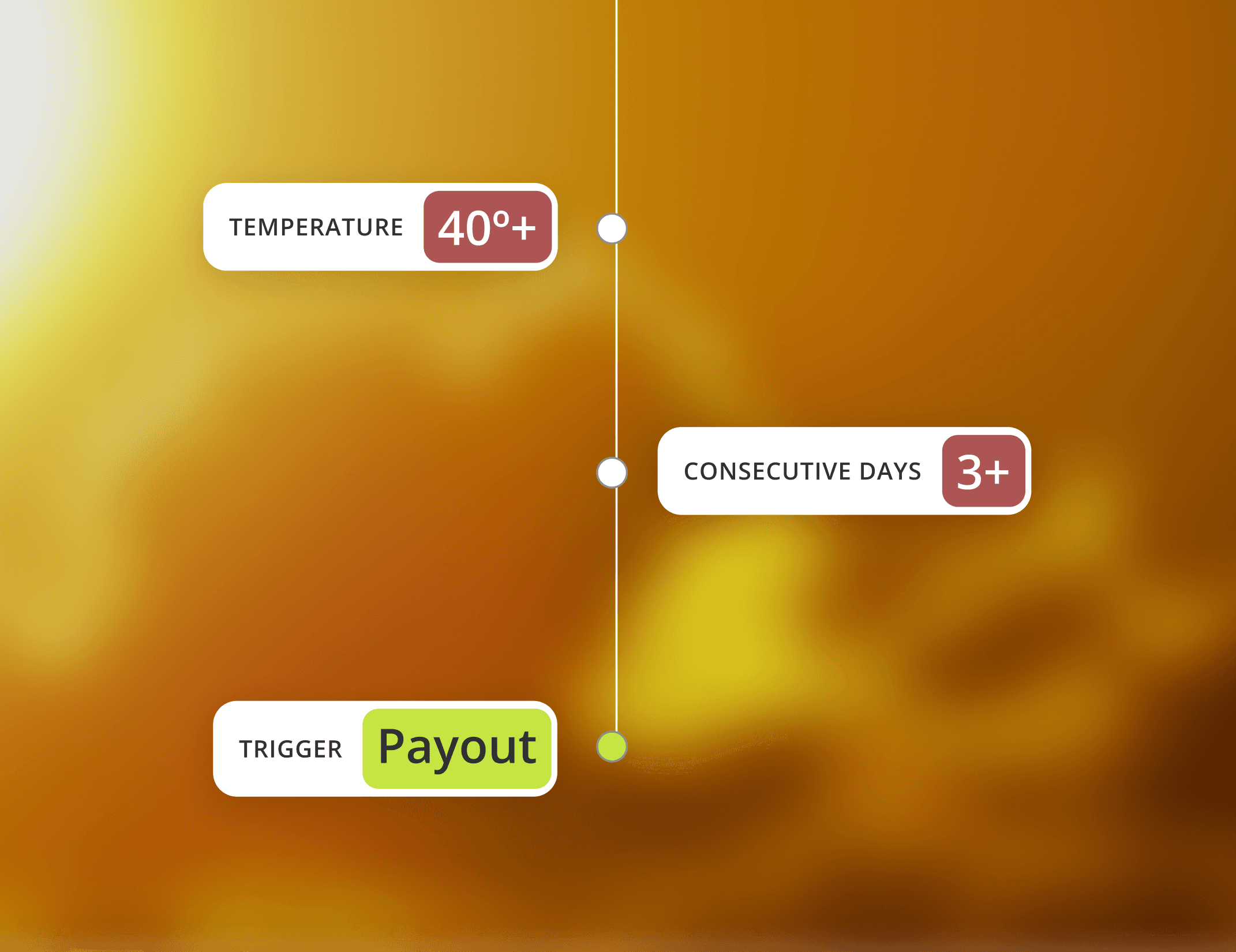

Trigger-Based Payouts with Predefined Conditions.

Trigger-Based Payouts with Predefined Conditions.

Trigger-Based Payouts with Predefined Conditions.

Payouts are predefined and agreed upon in advance. They are triggered by a measurable parameter (e.g., wind speed, maximum or minimum daily temperature, rainfall amount).

Payouts are predefined and agreed upon in advance. They are triggered by a measurable parameter (e.g., wind speed, maximum or minimum daily temperature, rainfall amount).

Payouts are predefined and agreed upon in advance. They are triggered by a measurable parameter (e.g., wind speed, maximum or minimum daily temperature, rainfall amount).

YOU DECIDE

Faster Payouts. Days – not weeks.

Faster Payouts. Days – not weeks.

Faster Payouts. Days – not weeks.

Since there’s no need for damage assessment like in traditional insurance, payouts are typically faster.

Since there’s no need for damage assessment like in traditional insurance, payouts are typically faster.

Since there’s no need for damage assessment like in traditional insurance, payouts are typically faster.

Since there’s no need for damage assessment like in traditional insurance, payouts are typically faster.

Since there’s no need for damage assessment like in traditional insurance, payouts are typically faster.

Since there’s no need for damage assessment like in traditional insurance, payouts are typically faster.

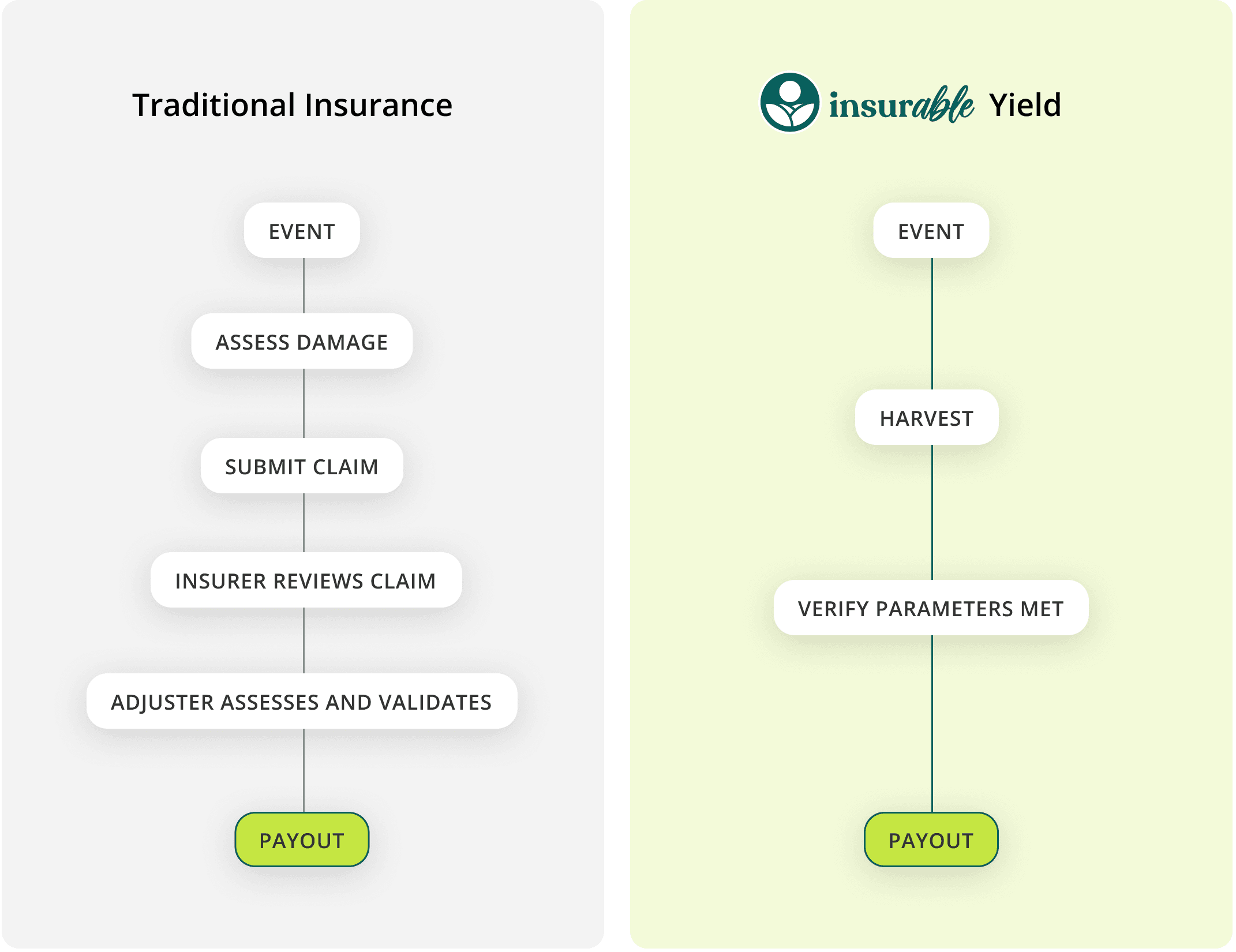

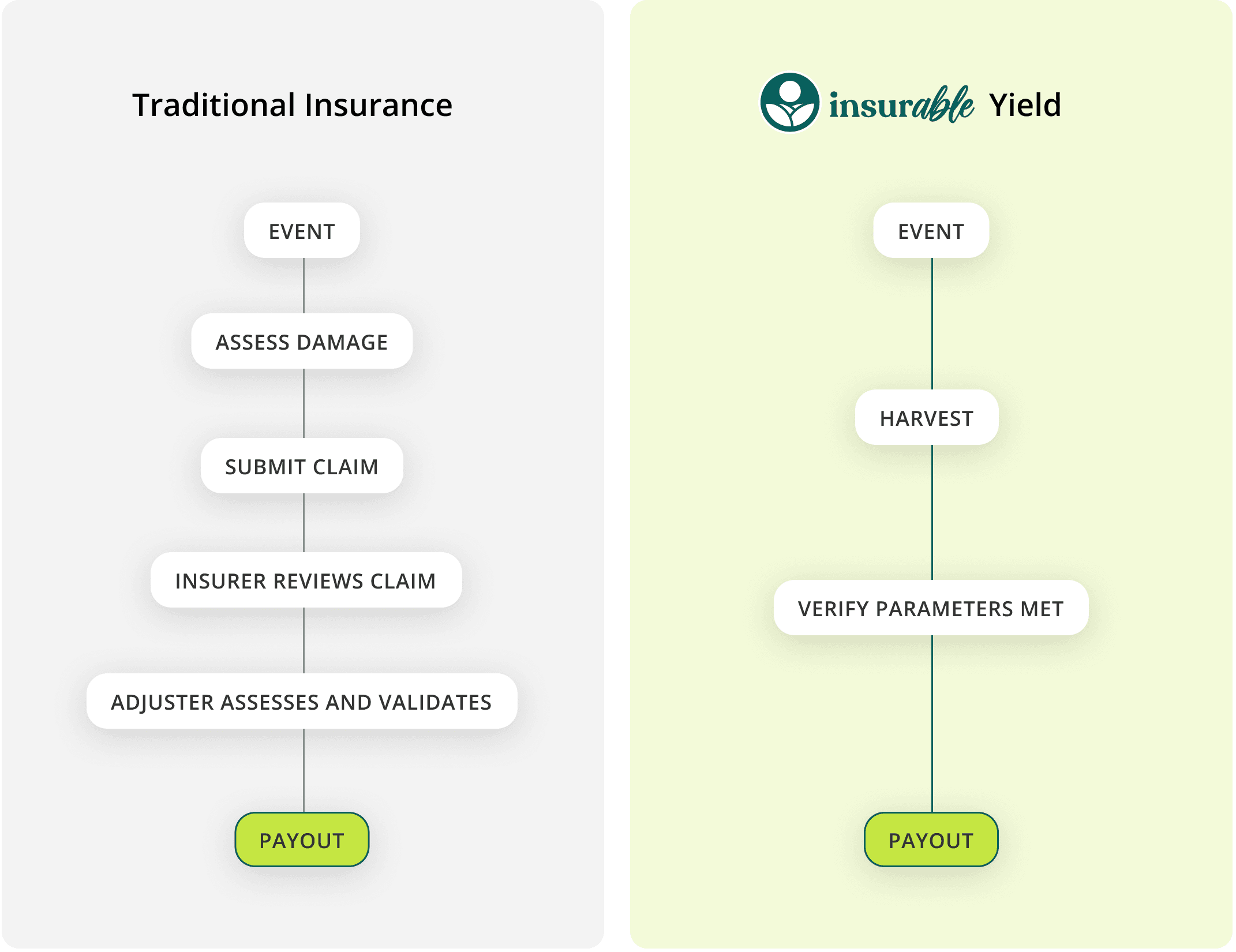

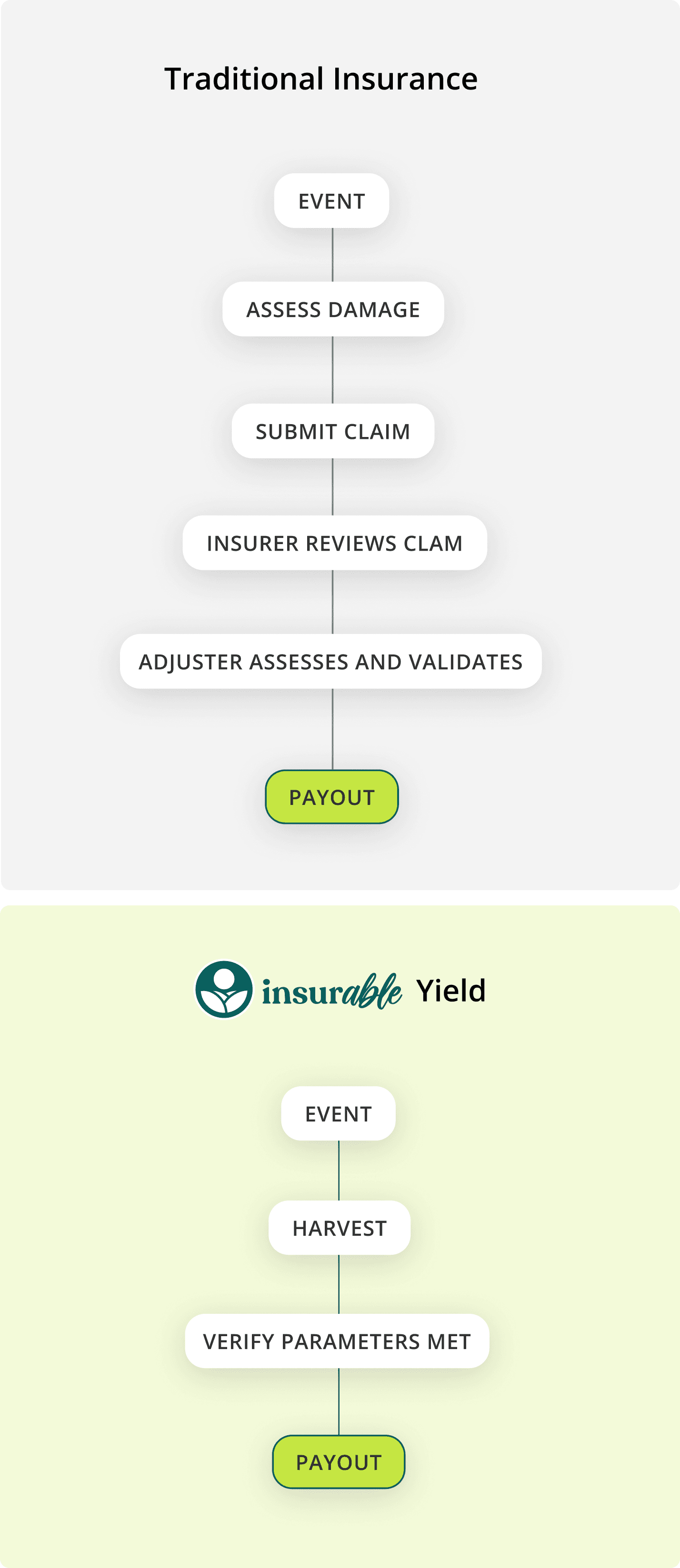

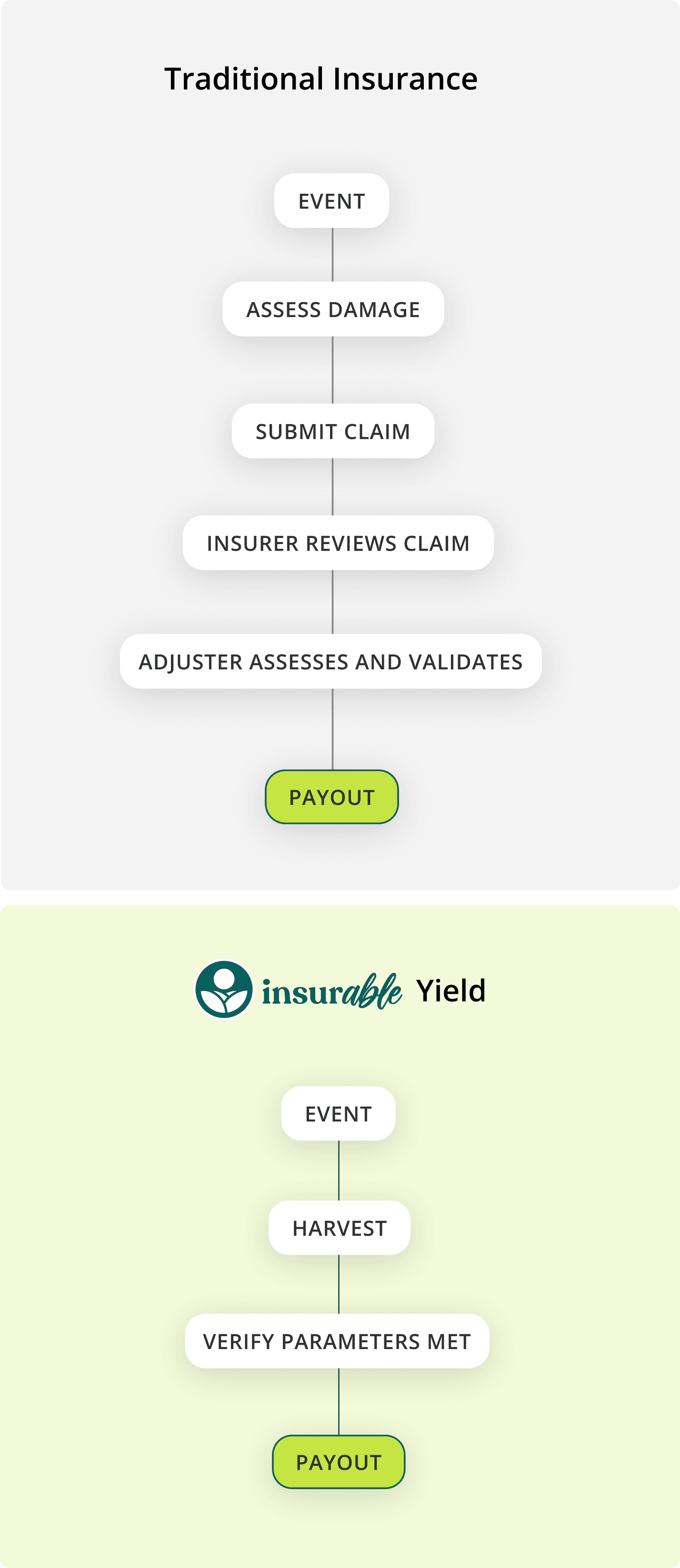

Fast and simple

claims process

Parametric Insurance

Often paid within days of conditions triggered

Minimal documentation

Vs

Traditional Insurance

Can take weeks or months

Extensive documentation – damage reports, photos etc.

insurable Weather

claim scenario examples

EXAMPLE 1

Frost Risk

Frost Risk

Frost Risk

Pays out if temperatures fall below a predefined threshold (e.g., -2°C for 2+ hours).

Pays out if temperatures fall below a predefined threshold (e.g., -2°C for 2+ hours).

Pays out if temperatures fall below a predefined threshold (e.g., -2°C for 2+ hours).

EXAMPLE 2

Hailstorms

Hailstorms

Hailstorms

Uses hail strike pads set up in paddocks to automatically detect hail.

Uses hail strike pads set up in paddocks to automatically detect hail.

Uses hail strike pads set up in paddocks to automatically detect hail.

EXAMPLE 3

Drought Risk

Drought Risk

Drought Risk

Pays if cumulative rainfall over a defined period falls below a set threshold (e.g., <20mm in 30 days).

Pays if cumulative rainfall over a defined period falls below a set threshold (e.g., <20mm in 30 days).

Pays if cumulative rainfall over a defined period falls below a set threshold (e.g., <20mm in 30 days).

Ready to switch to

Weather?

Request a Quote

If it's measurable,

it's

If it's measurable,

it's

If it's measurable,

it's

If it's measurable,

it's

OUR SERVICES

02.

02.

02.

02.

Yield

Yield

Yield

Yield

BEST SUITED FOR

Protecting income from general crop failure

Quick, formulaic payouts without inspection

Scalable benefits

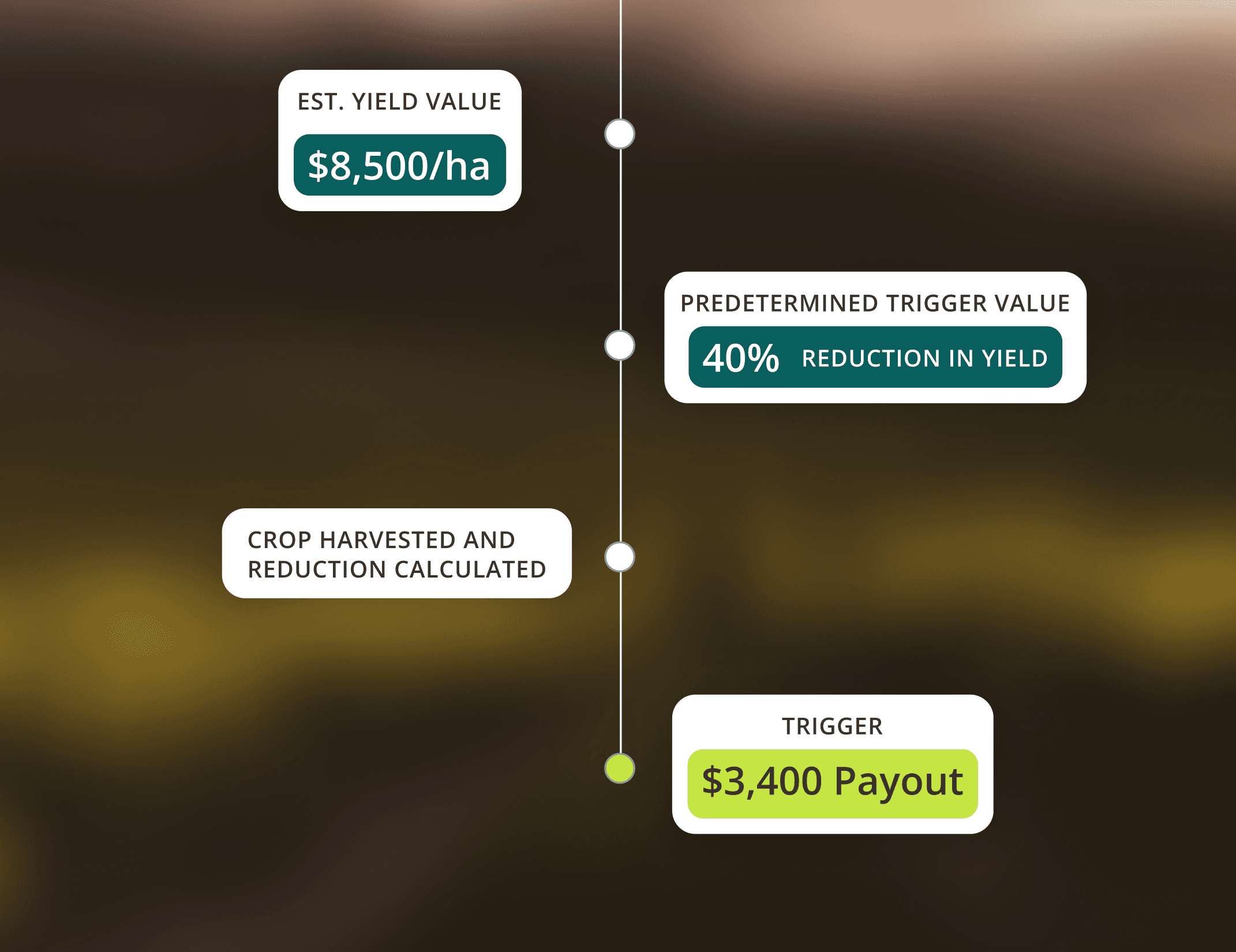

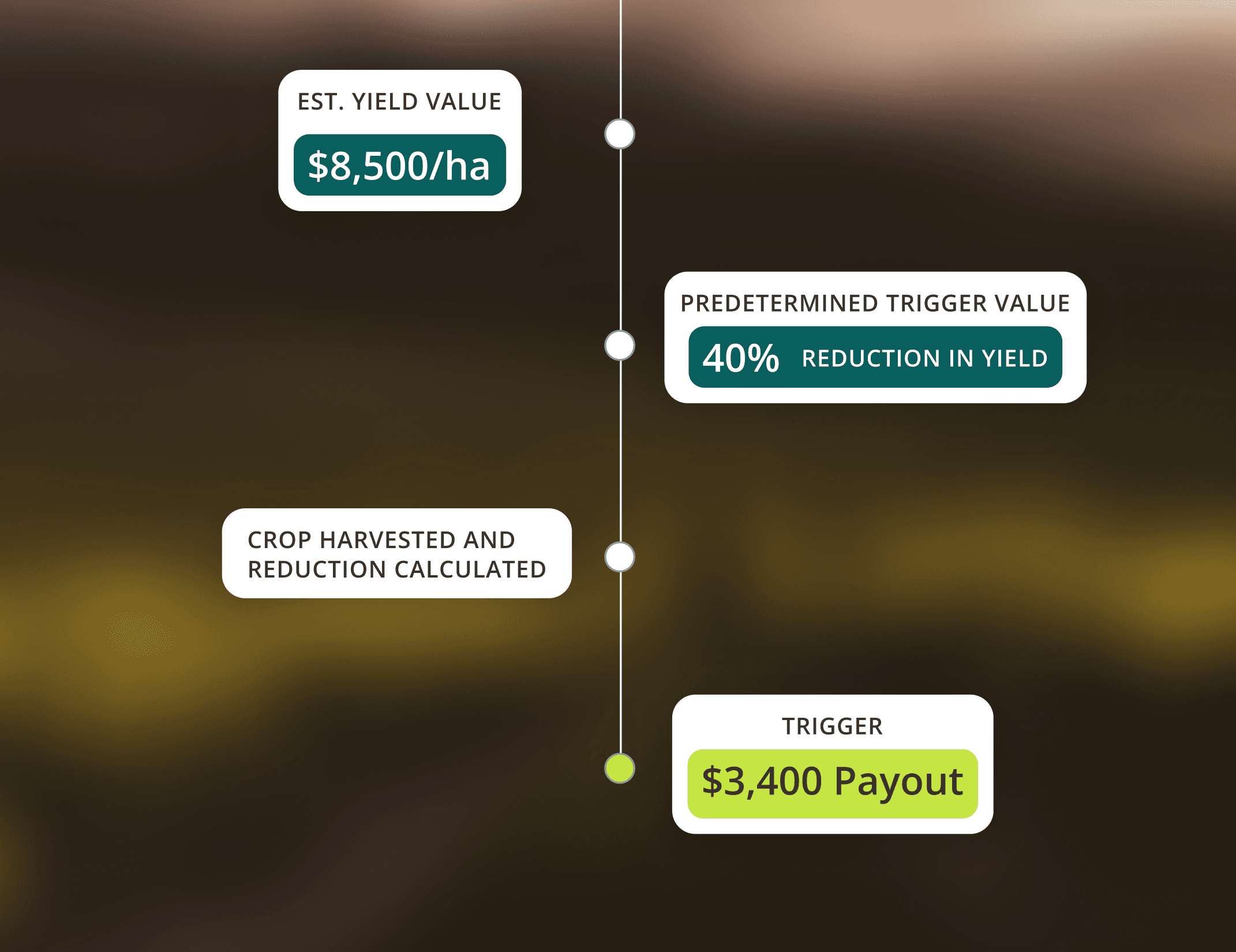

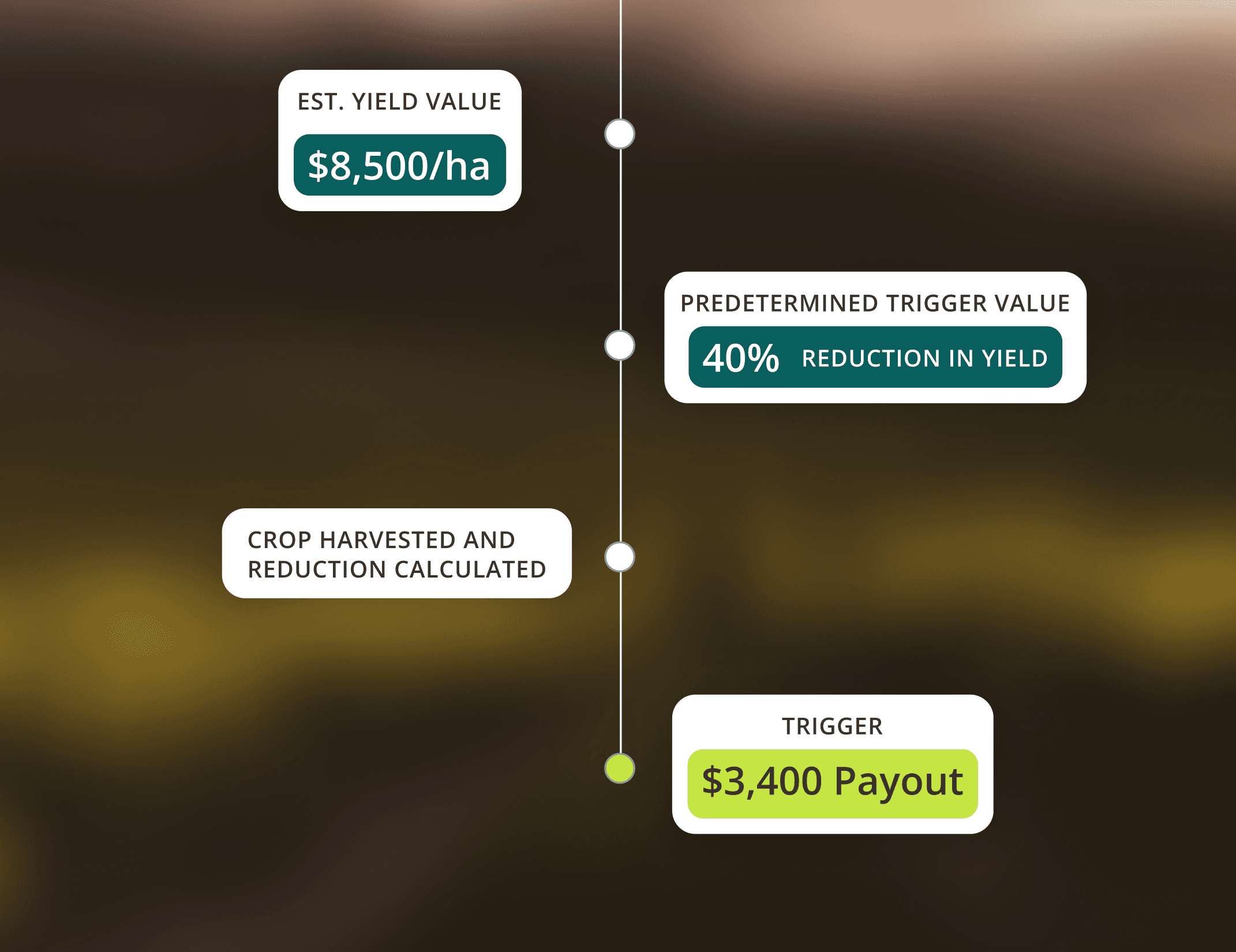

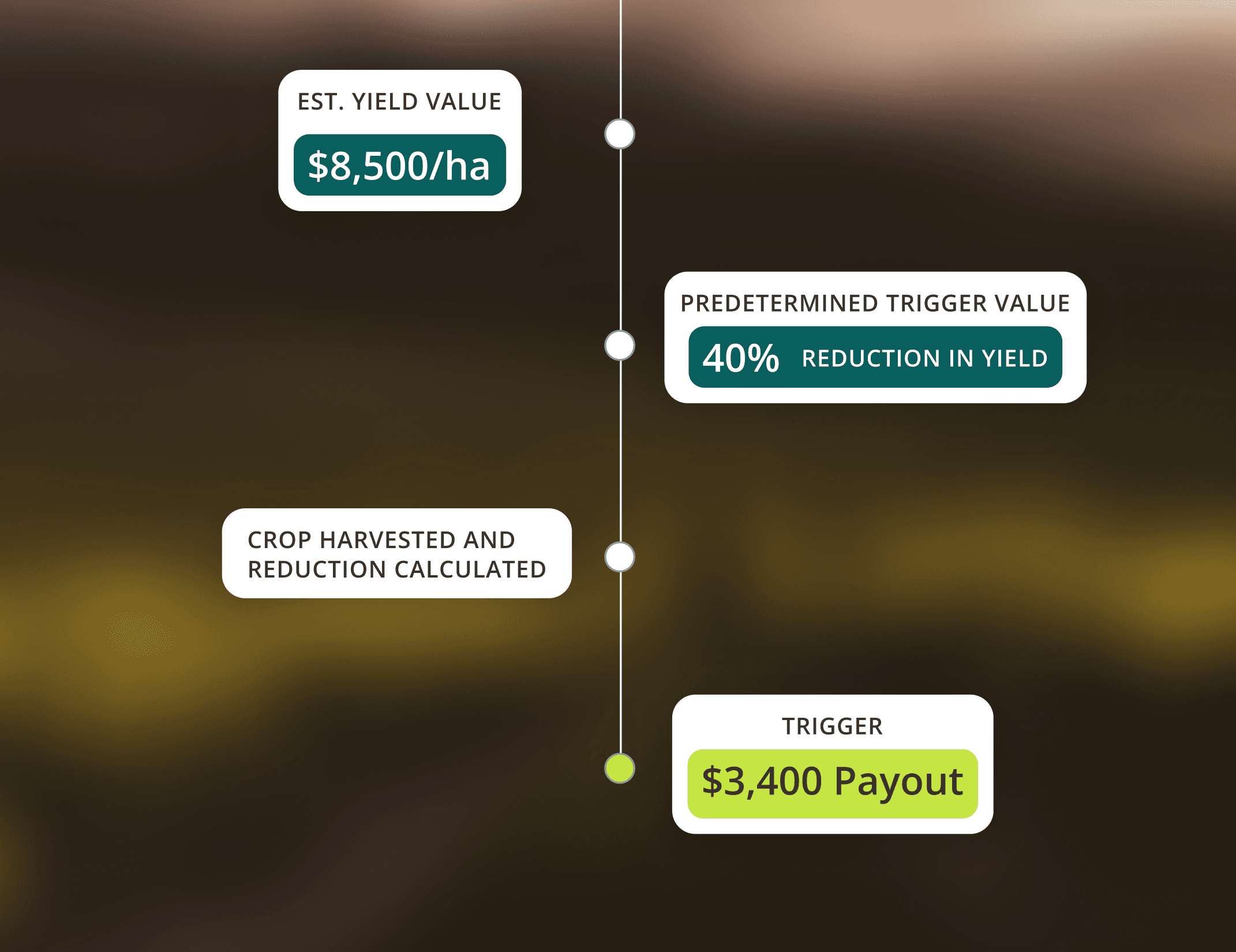

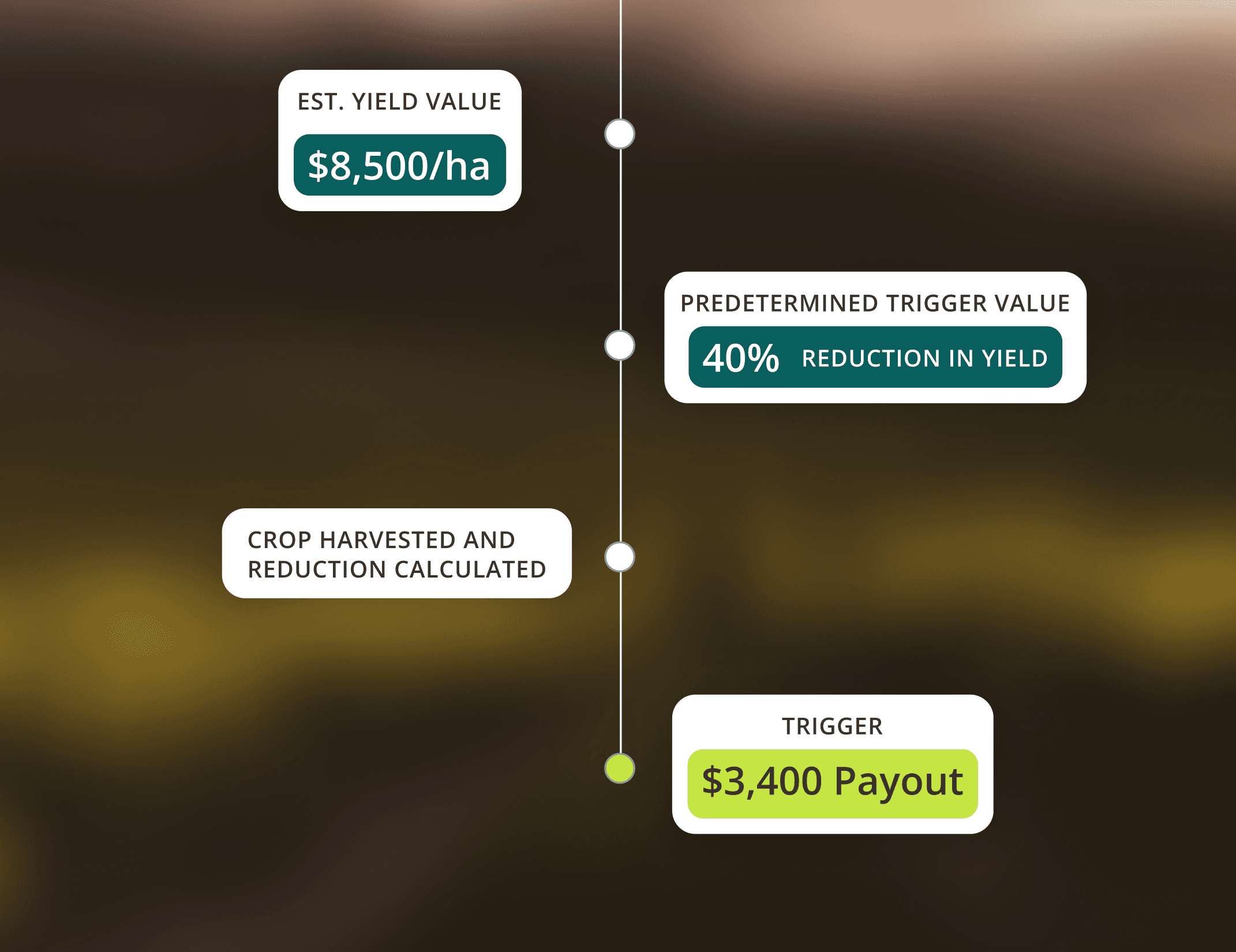

insurable Yield is a financial contract that pays out a predetermined amount when yields fall below a certain level over a specified time and region.

It differs from traditional insurance in so far as it does not directly cover damage or loss (primarily weather, pests or disease), rather the impact the damage or loss has on the overall yield.

insurable Yield is a financial contract that pays out a predetermined amount when yields fall below a certain level over a specified time and region.

It differs from traditional insurance in so far as it does not directly cover damage or loss (primarily weather, pests or disease), rather the impact the damage or loss has on the overall yield.

insurable Yield is a financial contract that pays out a predetermined amount when yields fall below a certain level over a specified time and region.

It differs from traditional insurance in so far as it does not directly cover damage or loss (primarily weather, pests or disease), rather the impact the damage or loss has on the overall yield.

Key features

of insurable Yield

SIMPLE TERMS – EASY SETTLEMENTS

Predefined, incremental claim payouts

Predefined, incremental claim payouts

Predefined, incremental claim payouts

Payouts are predefined and agreed upon in advance. Incremental claim settlements in line with the severity of yield reductions (eg 30%, 40% or 50% within a single policy)

Payouts are predefined and agreed upon in advance. Incremental claim settlements in line with the severity of yield reductions (eg 30%, 40% or 50% within a single policy)

Payouts are predefined and agreed upon in advance. Incremental claim settlements in line with the severity of yield reductions (eg 30%, 40% or 50% within a single policy)

YOU DECIDE

Faster Payouts. Days – not weeks.

Faster Payouts. Days – not weeks.

Faster Payouts. Days – not weeks.

Scalable benefits aligned to a reduction in crop yield with no requirement to prove actual losses. Once harvest has occurred and reductions calculated, a payout is triggered.

Scalable benefits aligned to a reduction in crop yield with no requirement to prove actual losses. Once harvest has occurred and reductions calculated, a payout is triggered.

Scalable benefits aligned to a reduction in crop yield with no requirement to prove actual losses. Once harvest has occurred and reductions calculated, a payout is triggered.

Scalable benefits aligned to a reduction in crop yield with no requirement to prove actual losses. Once harvest has occurred and reductions calculated, a payout is triggered.

Scalable benefits aligned to a reduction in crop yield with no requirement to prove actual losses. Once harvest has occurred and reductions calculated, a payout is triggered.

Scalable benefits aligned to a reduction in crop yield with no requirement to prove actual losses. Once harvest has occurred and reductions calculated, a payout is triggered.

Claim scenario examples

The following scenarios are based on a $8,500 per hectare yield forecast

EXAMPLE 1

Payout set at 30% in yield reduction

Payout set at 30% in yield reduction

Payout set at 30% in yield reduction

Predetermined Value

30%

Actual Yield Reduction

37.5%

Payout

$2,550/ha

EXAMPLE 2

Payout set at 40% in yield reduction

Payout set at 40% in yield reduction

Payout set at 40% in yield reduction

Predetermined Value

40%

Actual Yield Reduction

45%

Payout

$3,400/ha

EXAMPLE 3

Payout set at 50% in yield reduction

Payout set at 50% in yield reduction

Payout set at 50% in yield reduction

Predetermined Value

50%

Actual Yield Reduction

53%

Payout

$4,250/ha

Claim scenario examples

The following scenarios are based on a $8,500 per hectare yield forecast

EXAMPLE 1

Payout set at 30% in yield reduction

Predetermined Value

30%

Actual Yield Reduction

37.5%

Payout

$2,550/ha

EXAMPLE 2

Payout set at 40% in yield reduction

Predetermined Value

40%

Actual Yield Reduction

45%

Payout

$3,400/ha

EXAMPLE 3

Payout set at 50% in yield reduction

Predetermined Value

50%

Actual Yield Reduction

53%

Payout

$4,250/ha

Claim scenario examples

The following scenarios are based on a $8,500 per hectare yield forecast

EXAMPLE 1

Payout set at 30% in yield reduction

Predetermined Value

30%

Actual Yield Reduction

37.5%

Payout

$2,550/ha

EXAMPLE 2

Payout set at 40% in yield reduction

Predetermined Value

40%

Actual Yield Reduction

45%

Payout

$3,400/ha

EXAMPLE 3

Payout set at 50% in yield reduction

Predetermined Value

50%

Actual Yield Reduction

53%

Payout

$4,250/ha

Claim scenario examples

The following scenarios are based on a $8,500 per hectare yield forecast

EXAMPLE 1

Payout set at 30% in yield reduction

Predetermined Value

30%

Actual Yield Reduction

37.5%

Payout

$2,550/ha

EXAMPLE 2

Payout set at 40% in yield reduction

Predetermined Value

40%

Actual Yield Reduction

45%

Payout

$3,400/ha

EXAMPLE 3

Payout set at 50% in yield reduction

Predetermined Value

50%

Actual Yield Reduction

53%

Payout

$4,250/ha

Ready to switch to

Yield?

Request a Quote

Contact us or request a quote

Contact us

or request a quote

Contact us

or request a quote

Frequently Asked Questions

Frequently

Asked Questions

Frequently

Asked Questions

General

Who is insurable?

Who is insurable?

Who is insurable?

Who is insurable?

Who is insurable?

Who is insurable?

What is parametric insurance?

What is parametric insurance?

What is parametric insurance?

What is parametric insurance?

What is parametric insurance?

What is parametric insurance?

How can I contact insurable?

How can I contact insurable?

How can I contact insurable?

How can I contact insurable?

How can I contact insurable?

How can I contact insurable?

Where can I leave feedback or make a complaint?

Where can I leave feedback or make a complaint?

Where can I leave feedback or make a complaint?

Where can I leave feedback or make a complaint?

Where can I leave feedback or make a complaint?

Where can I leave feedback or make a complaint?

Product

What industry/ies does insurable cover?

What industry/ies does insurable cover?

What industry/ies does insurable cover?

What industry/ies does insurable cover?

What industry/ies does insurable cover?

What industry/ies does insurable cover?

How does insurable differ from traditional insurance?

How does insurable differ from traditional insurance?

How does insurable differ from traditional insurance?

How does insurable differ from traditional insurance?

How does insurable differ from traditional insurance?

How does insurable differ from traditional insurance?

How much insurance do I need?

How much insurance do I need?

How much insurance do I need?

How much insurance do I need?

How much insurance do I need?

How much insurance do I need?

What other insurance products can you help me with?

What other insurance products can you help me with?

What other insurance products can you help me with?

What other insurance products can you help me with?

What other insurance products can you help me with?

What other insurance products can you help me with?

Quotes

How do I arrange a quote?

How do I arrange a quote?

How do I arrange a quote?

How do I arrange a quote?

How do I arrange a quote?

How do I arrange a quote?

I have a question about / need help with my quote.

I have a question about / need help with my quote.

I have a question about / need help with my quote.

I have a question about / need help with my quote.

I have a question about / need help with my quote.

I have a question about / need help with my quote.

How do I finalise my quote?

How do I finalise my quote?

How do I finalise my quote?

How do I finalise my quote?

How do I finalise my quote?

How do I finalise my quote?

Policy

How do I make changes to my new or existing policy?

How do I make changes to my new or existing policy?

How do I make changes to my new or existing policy?

How do I make changes to my new or existing policy?

How do I make changes to my new or existing policy?

How do I make changes to my new or existing policy?

How do I renew my policy?

How do I renew my policy?

How do I renew my policy?

How do I renew my policy?

How do I renew my policy?

How do I renew my policy?

I need to cancel my policy.

I need to cancel my policy.

I need to cancel my policy.

I need to cancel my policy.

I need to cancel my policy.

I need to cancel my policy.

Claims

How do I make a claim?

How do I make a claim?

How do I make a claim?

How do I make a claim?

How do I make a claim?

How do I make a claim?

What is involved in lodging a claim?

What is involved in lodging a claim?

What is involved in lodging a claim?

What is involved in lodging a claim?

What is involved in lodging a claim?

What is involved in lodging a claim?

Is there a time limit for lodging a claim?

Is there a time limit for lodging a claim?

Is there a time limit for lodging a claim?

Is there a time limit for lodging a claim?

Is there a time limit for lodging a claim?

Is there a time limit for lodging a claim?

Will my premium increase if I make a claim?

Will my premium increase if I make a claim?

Will my premium increase if I make a claim?

Will my premium increase if I make a claim?

Will my premium increase if I make a claim?

Will my premium increase if I make a claim?

Who can I talk to about my claim in progress?

Who can I talk to about my claim in progress?

Who can I talk to about my claim in progress?

Who can I talk to about my claim in progress?

Who can I talk to about my claim in progress?

Who can I talk to about my claim in progress?

This information and advice provided by insurable is general in nature and has not taken into account your specific circumstances. You should consider the appropriateness of this advice in light of your own financial situation and objectives.

If you are considering acquiring a policy, you should obtain a copy of the Product Disclosure Statement (PDS) for that product and read it carefully before making any decisions. We are not liable for any losses or damages that may arise from acting on this advice. If you have any questions or concerns, please do not hesitate to contact us.

© 2025 insurable Pty Ltd